The way people search for information online is undergoing a rapid transformation. While Google remains the dominant entry point to the web, AI chatbots such as ChatGPT, Claude, and Perplexity are quickly emerging as serious alternatives.

New data compiled by digital marketing firm OneLittleWeb shows that while chatbot usage has soared over the past year, it still lags far behind traditional search engines in terms of total user engagement.

The study, based on global traffic data from SEMrush and aitools.xyz, compares usage trends from April 2023 to March 2025 across the 10 most visited AI chatbots and 10 top search engines.

Key Findings at a Glance

- AI Chatbots Grew 81% in One Year

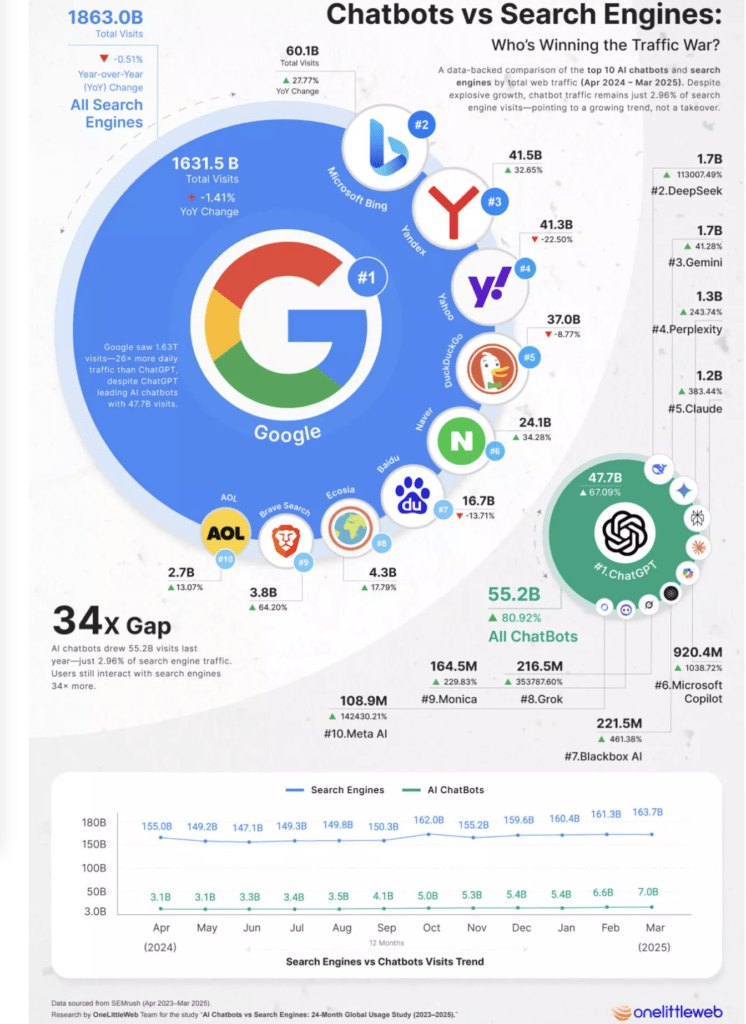

AI chatbots registered a year-on-year traffic increase of 80.9% between April 2024 and March 2025, reaching 55.2 billion visits. This compares to 30.5 billion visits the previous year. - Search Engines Decline Marginally

In the same period, search engines recorded a modest 0.51% drop, falling from 1.87 trillion to 1.86 trillion visits. - Chatbots Still Trail by a Wide Margin

Despite strong growth, AI chatbots accounted for just 2.96% of search engines’ total traffic over the past year—roughly one visit for every 34 to a search engine. Daily visits in March 2025 averaged 233 million for chatbots versus 5.5 billion for search engines. - Google and ChatGPT Dominate Their Sectors

Google retained an 87.6% market share among search engines, while ChatGPT commanded 86.3% of chatbot traffic. - New Entrants on the Rise

Grok and DeepSeek emerged as fast-growing players in the chatbot space, while Yahoo saw a 22.5% decline in search traffic, underscoring the divergence in platform performance.

Search Remains Dominant—For Now

For SEO professionals and publishers who rely on organic search traffic, the shift toward conversational AI presents both risks and opportunities. However, OneLittleWeb’s data suggests that chatbots are not yet displacing search engines as the web’s primary information access point.

Even in March 2025—after months of chatbot acceleration—search engines were still averaging nearly 24 times more daily visits than chatbots.

In fact, Google alone recorded 4.7 billion average daily visits over the last 12 months, compared to ChatGPT’s 185.2 million.

Month-to-Month Trends Paint a Nuanced Picture

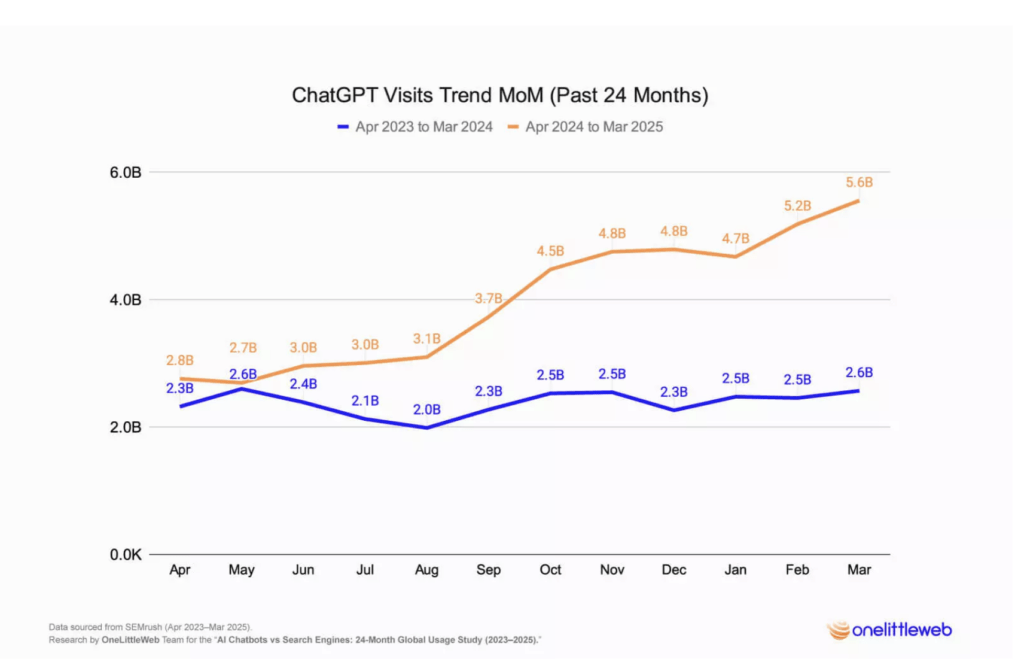

A closer look at monthly data reveals more complex dynamics. AI chatbot traffic grew steadily, more than doubling from 3.1 billion visits in April 2024 to 7 billion in March 2025. The surge appears to have begun in September 2024, aligning with broader integration of AI tools into everyday applications.

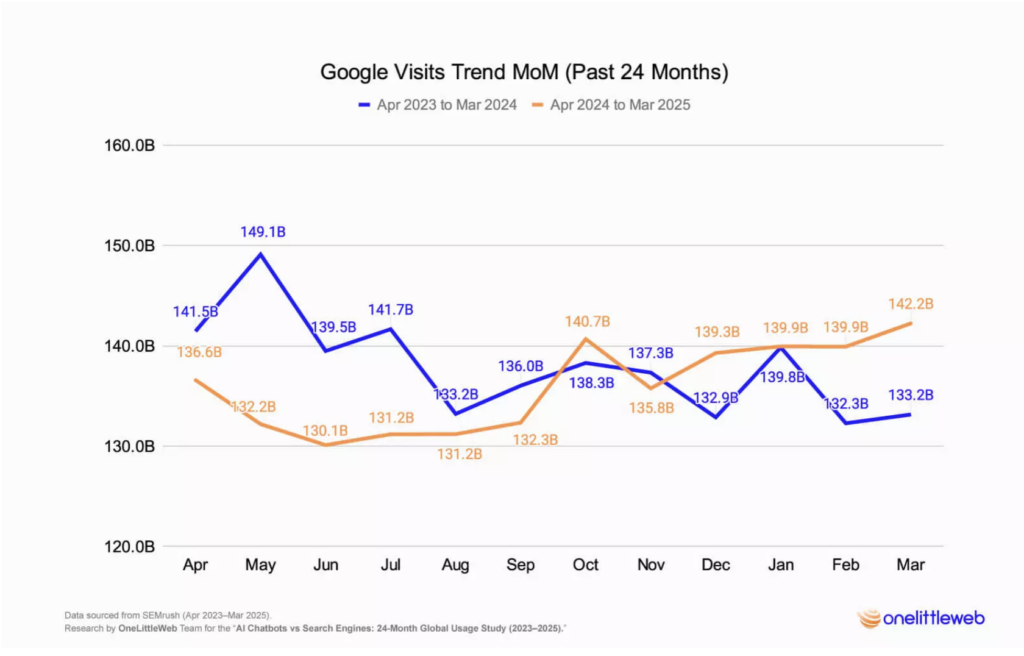

Search engines, meanwhile, recovered from a mid-2024 dip. Visits bottomed out at 147.1 billion in June before rising to 163.7 billion by March 2025—the highest level in 12 months.

Much of this resurgence is credited to the rollout of AI-powered search features such as Google’s AI Overviews and Microsoft Bing’s SGE (Search Generative Experience).

Market Leaders and Platform Shifts

In the AI space, ChatGPT’s dominance remains overwhelming, with over 86% of chatbot traffic. Still, competitors such as Perplexity, DeepSeek, and Claude are growing quickly—often through browser integrations or mobile-first approaches.

On the search engine front, Google’s supremacy is unmatched, although Microsoft Bing and Yandex have solidified their positions in second and third place, respectively. Yahoo, on the other hand, has struggled to keep pace, with traffic declining significantly over the last year.

Top 10 Chatbots

The AI chatbot landscape is becoming increasingly competitive, but OpenAI’s ChatGPT continues to dwarf its rivals in terms of usage, according to a new industry traffic analysis covering April 2024 to March 2025.

The report reveals that while ChatGPT expanded its total visits by 67.09% year-over-year to 47.7 billion, accounting for an overwhelming 86.32% of all chatbot traffic, emerging players like DeepSeek, Perplexity, and Claude are registering eye-catching growth as users explore alternatives.

“ChatGPT’s momentum shows no signs of slowing,” the report notes, pointing to the platform’s 185.2 million daily visits in March 2025—more than the combined daily traffic of several other top chatbots. This growth has been fueled by ongoing product updates, such as the release of GPT-4.1 and native integrations for coding, browsing, and image generation.

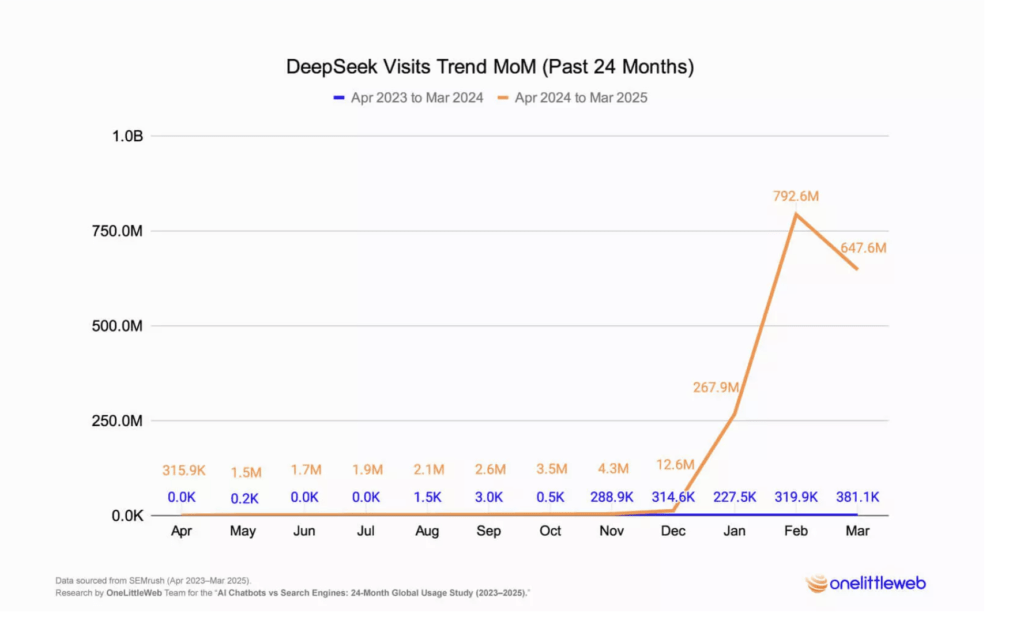

Yet, the report also highlights shifting dynamics, with newer entrants gaining traction rapidly. China-based DeepSeek, for instance, saw an astronomical 113,007% year-on-year growth, jumping from just 1.5 million visits in the prior year to 1.7 billion—despite a slight dip in March 2025.

The platform’s recent launch of DeepSeek-V3-0324, which features enhanced reasoning and coding capabilities, has attracted developer interest and increased competition with OpenAI.

“Despite an 18% month-over-month drop in March, DeepSeek maintains its position as a formidable player,” analysts wrote. “Its open-source model and cost-effective infrastructure signal strong potential for a rebound in engagement.”

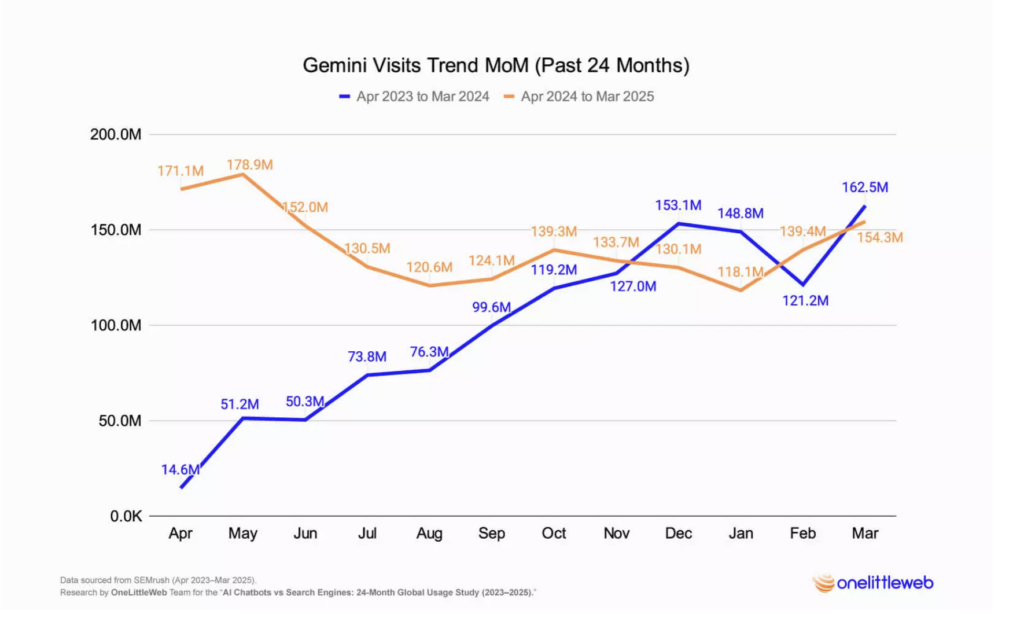

Gemini Climbs to 1.7 Billion Visits

Google’s Gemini also grew, albeit at a more measured 41.28%, reaching 1.7 billion total visits over the past year.

The platform struggled with maintaining momentum in the second half of the year, but recent updates such as Gemini Live and the video model Veo 2 may help it retain its core user base.

The report adds, “While Gemini offers innovative tools, it hasn’t significantly expanded its user base… limited global availability and app integration may be hindering adoption.”

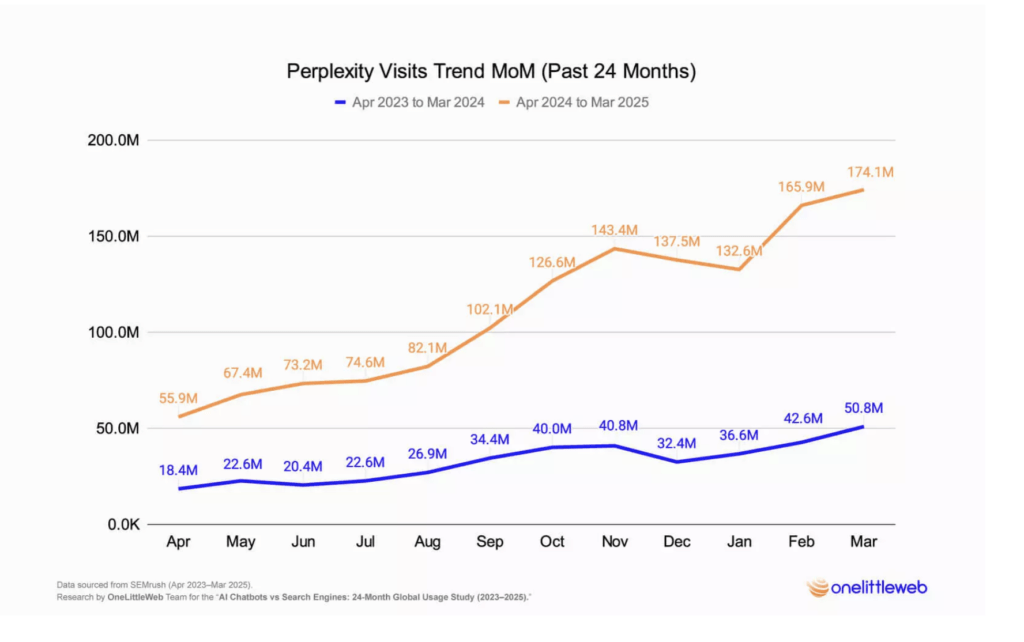

Meanwhile, Perplexity AI, known for its source-cited answers and clean interface, clocked 1.3 billion visits, representing a 243.74% jump.

In March alone, it recorded 174.1 million visits, with the report pointing to upcoming partnerships with Motorola and possibly Samsung as key drivers of future growth.

“Although Perplexity’s adoption curve is currently moderate, its commitment to innovation and strategic partnerships positions it for accelerated growth.”

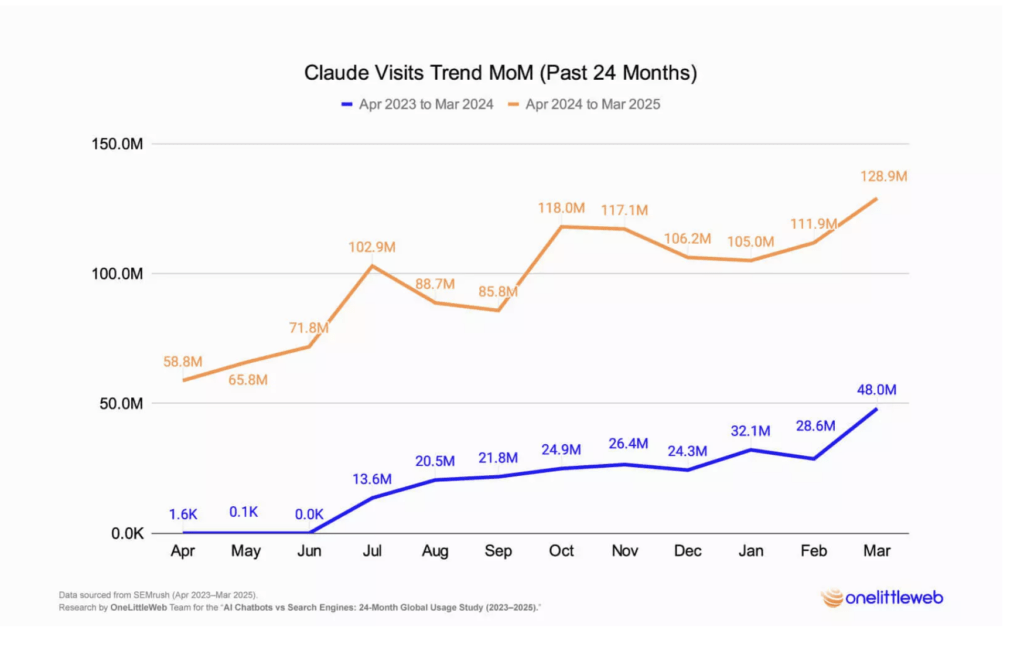

Anthropic’s Claude also showed strong upward momentum, with 1.2 billion visits—a 383.44% YoY increase.

Its new Claude 3.7 Sonnet model with hybrid reasoning and Google Workspace integration has started gaining traction among professional users, according to the report.

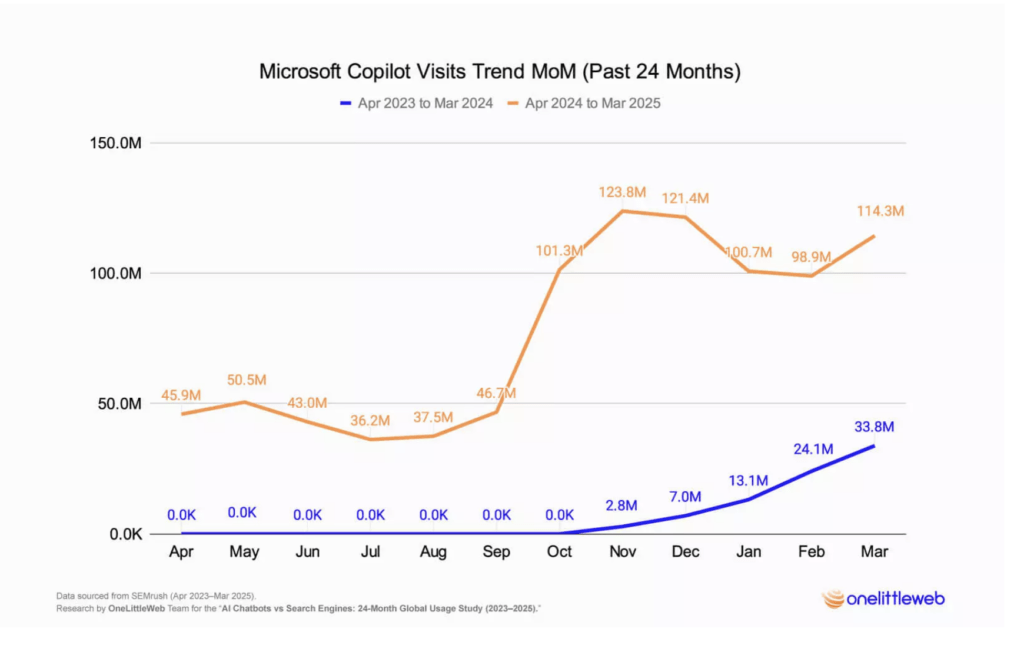

Microsoft’s Copilot is perhaps the most significant comeback story of the year.

After launching more deeply within Microsoft 365 and Windows ecosystems, Copilot recorded a 1038.72% YoY increase, reaching 920.4 million total visits. Copilot Vision, allows users to interact with on-screen content through voice in Edge, while Copilot Studio enables AI agents to manipulate websites.

“This positions Copilot as not just a chatbot, but a productivity platform embedded into daily workflows,” the report states.

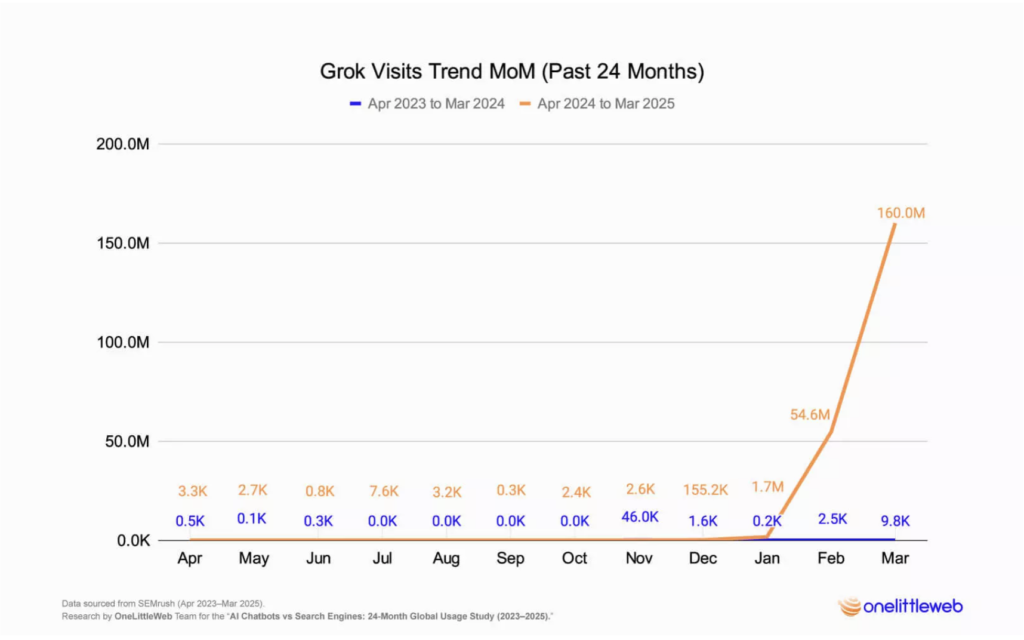

Grok experienced a dramatic rise in traffic, reaching 216.5 million visits, a staggering 353,787.60% YoY growth from just 61,200 the previous year.

Averaging 18 million visits per month, Grok’s surge is primarily attributed to its rapid adoption in the final quarter of the year.

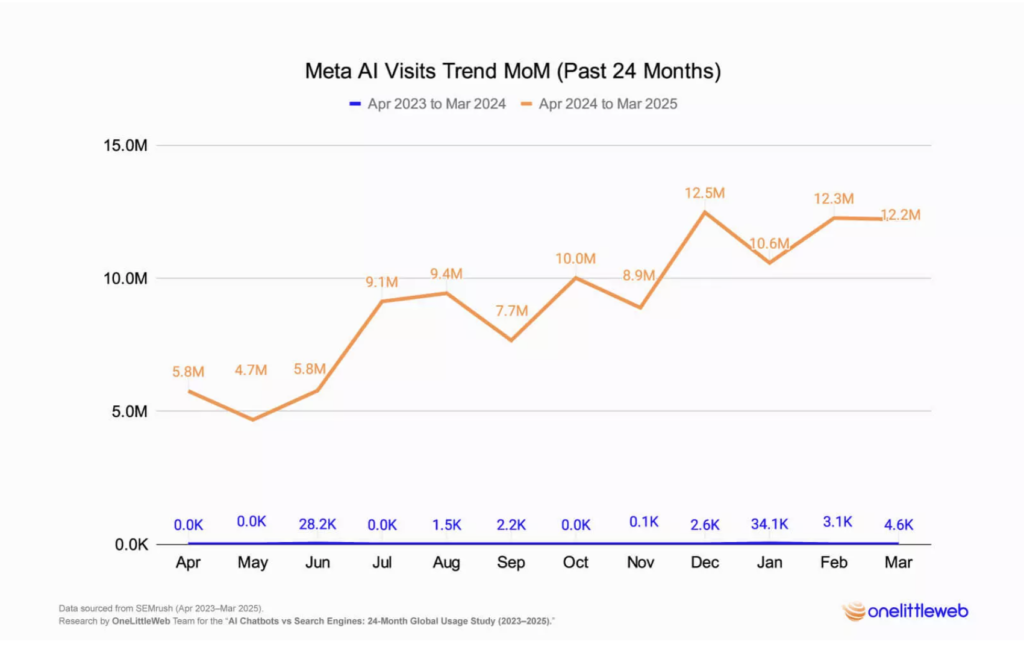

Despite Meta’s robust infrastructure and the release of its powerful open-source LLaMA models, Meta AI’s user engagement remains modest.

This is attributed to its limited global availability—recently expanding to 41 European countries with certain feature restrictions—and its integration within existing apps, which may lead to less intentional user interactions.

Meta AI reached 108.9 million visits, up from just 76,400 the year before—an enormous 142,430% YoY growth, though still the smallest among the top 10 in total volume.

Other notable performers include Blackbox AI, a developer-centric tool that saw traffic rise 461.38% to 221.5 million visits, and Monica, which saw its yearly visits grow to 164.5 million, up from 49.9 million the year prior—a 229.83% YoY increase.

While ChatGPT’s dominance remains intact, the numbers point to a market that is beginning to fragment. Analysts suggest that product specialization, regional strategies, and integration into hardware and workplace tools will become key differentiators moving forward.

How Are Legacy Search Engines Performing?

Google maintained its iron grip on the global search market, amassing a staggering 1.63 trillion visits in the past year alone.

Despite a modest 1.41% decline in traffic compared to the previous year, the report notes that Google still commanded 87.57% of all search engine traffic, making it the most visited website on the planet.

“Google’s continued dominance reaffirms its role as the default gateway to the internet—even as it navigates the complexities of integrating AI into its ecosystem,” the report states.

It highlights how Google’s introduction of AI-generated overviews, conversational search via its Gemini platform, and the expanding Search Generative Experience (SGE) have helped maintain user interest.

In March 2025 alone, the tech giant averaged 4.7 billion daily visits, showing that users continue to trust its core functions even in an AI-first world.

Not all traditional search engines have fared as well.

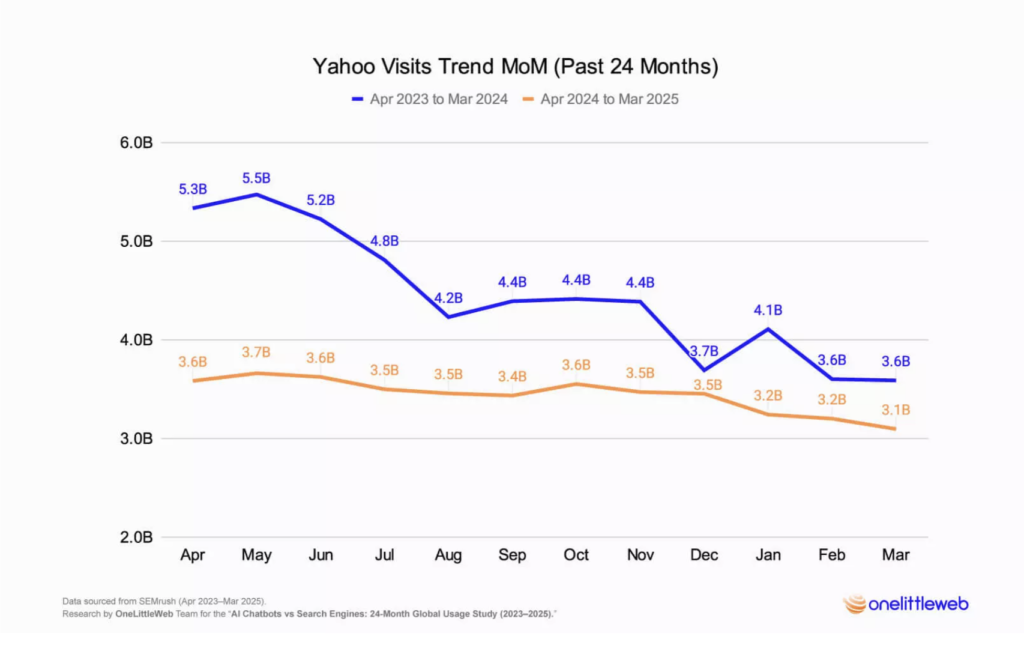

Yahoo, once a pioneer of the early internet era, has seen a stark 22.5% year-over-year drop in traffic, falling from 53.2 billion visits in 2023–24 to 41.3 billion in the latest period.

“Yahoo’s inability to keep pace with AI advancements has contributed to its ongoing decline,” the report warns. It points out that Yahoo averaged just 3.4 billion monthly visits this year, compared to Google’s 136 billion.

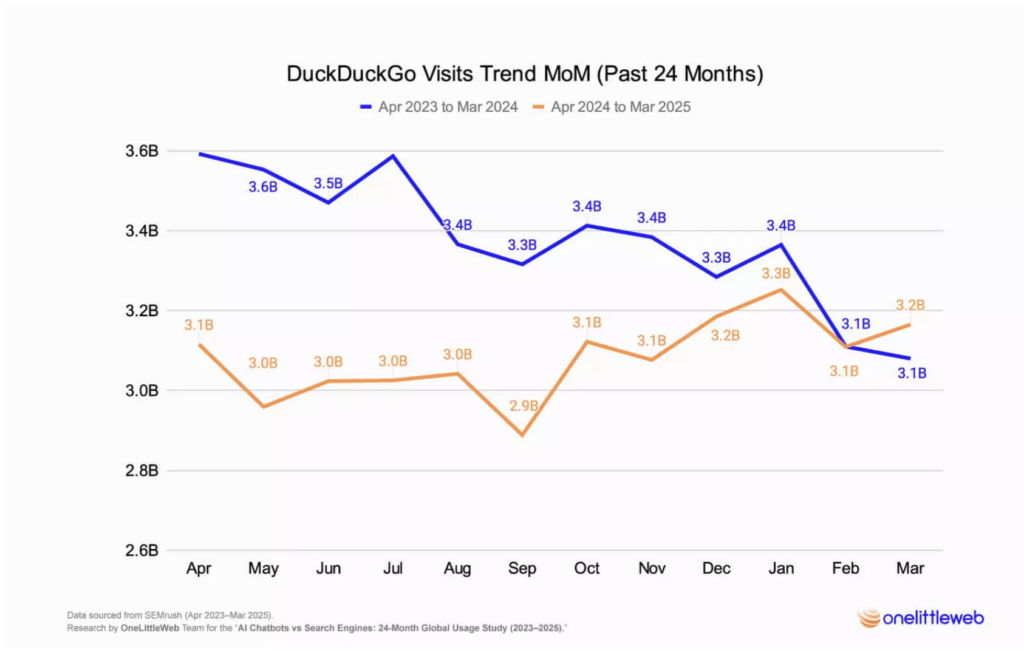

DuckDuckGo, the privacy-centric search engine, also saw a decline of 8.77%, bringing its total visits to 37 billion.

While the platform has rolled out its own AI assistant, Duck.AI, powered by GPT-4, it appears that privacy alone may no longer be enough to drive growth.

“Despite its strong value proposition, DuckDuckGo risks falling behind unless it accelerates innovation and marketing efforts,” the report cautions.

In contrast, a few challengers are not only surviving—but thriving.

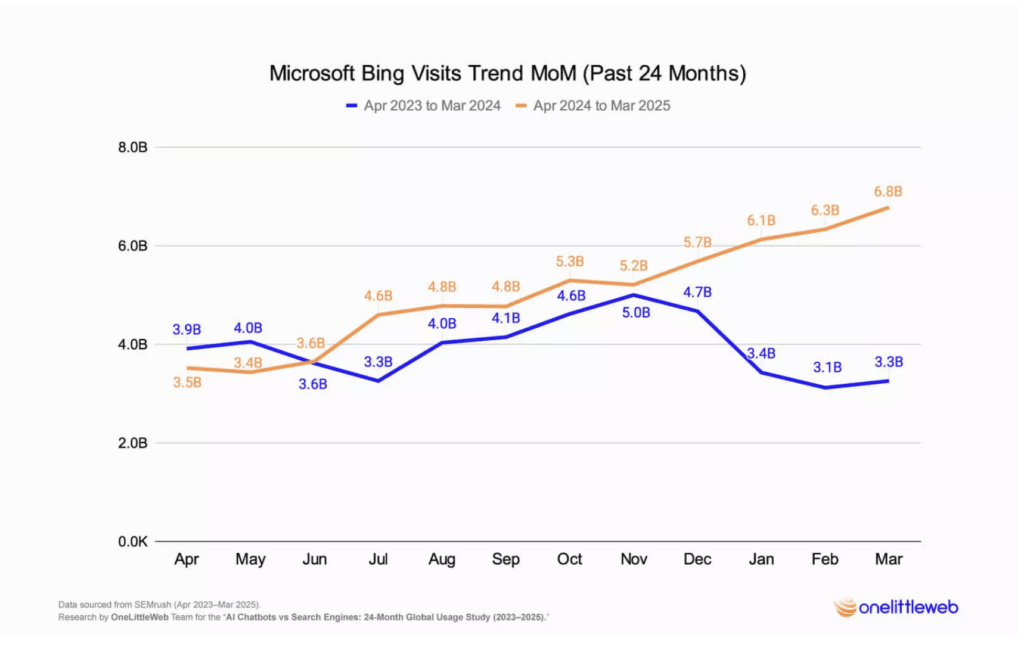

Microsoft Bing recorded the most substantial growth among major players, with a 27.77% increase in visits.

The platform logged 60.1 billion total visits, driven in part by its deep integration of AI tools such as Copilot and GPT-powered search responses.

Bing saw its monthly traffic nearly double over the year, rising from 3.5 billion in April 2024 to 6.8 billion in March 2025.

“This growth trajectory reflects Microsoft Bing’s evolving role—not just as a search engine, but as an AI-powered productivity hub,” the report emphasizes.

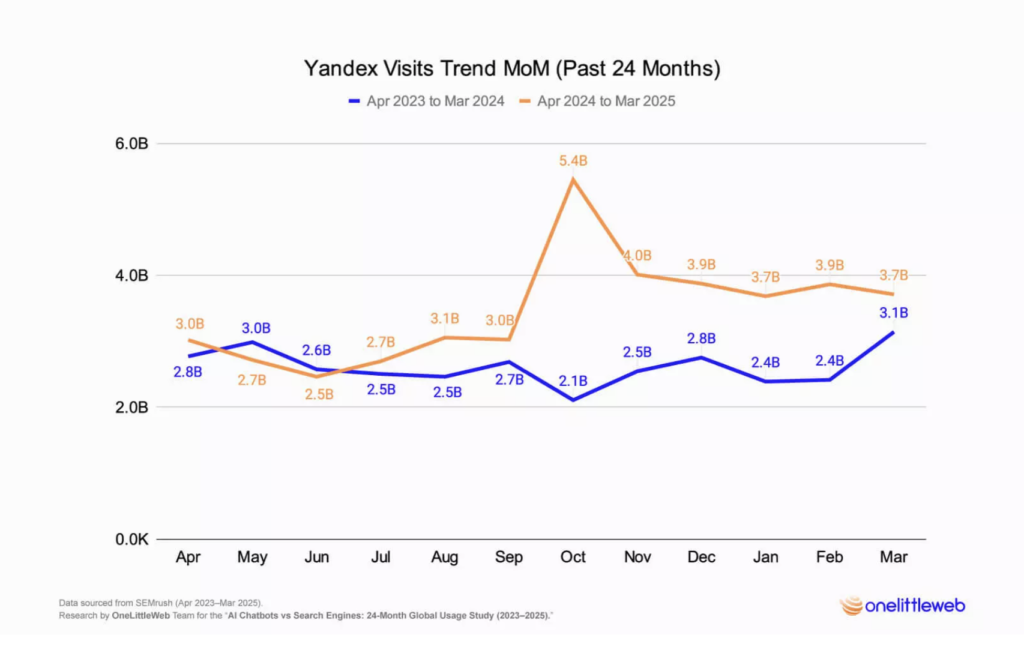

Russian-based Yandex and South Korean platform Naver also posted robust growth, with Yandex visits up by 32.65% and Naver up by 34.28%.

The report attributes this surge to “strong regional loyalty and enhanced AI features,” especially in markets where these platforms are deeply embedded in local user behavior.

In March 2025, Yandex averaged 123.7 million daily visits, while Naver reported 69.9 million, pointing to consistent engagement. “These platforms are capitalizing on local relevance and technical upgrades, even as global competition intensifies,” the report states.

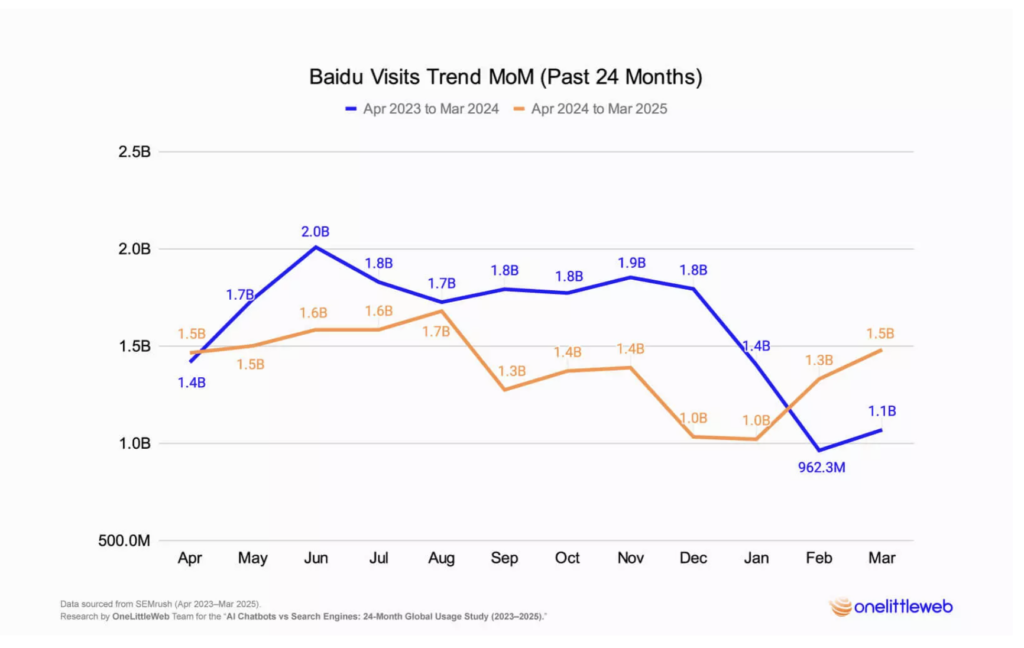

Baidu Lost 3 Billion Visits

Baidu registered a 13.71% decline in total visits, falling to 16.7 billion visits, down from 19.4 billion the previous year.

Despite this drop, the report asserts that “Baidu continues to be a prominent player in China’s search engine market,” though its global competitiveness appears to be weakening.

The platform averaged 1.4 billion monthly visits during the 12-month period, while in March 2025, its daily traffic fell to 49.3 million—a number the report describes as “significant, but declining.”

Yet amid the slump, analysts point to a recent glimmer of progress. The report notes “a slight uptick in February and March 2025,” largely credited to Baidu’s integration of DeepSeek’s AI technology, including DeepSeek R1 and Baidu’s own Ernie models.

“This rebound marks a significant shift in Baidu’s search engine experience,” the report states. The company began grayscale testing of its AI-driven tools in February 2025, in an effort to catch up to global competitors such as Google and Microsoft Bing, both of which have aggressively embedded AI into their search infrastructure.

While Baidu’s AI push has helped arrest some of the traffic decline, the report warns that “the true test will be whether these updates can sustain long-term growth and capture a more significant share of global search engine traffic.”

Micro Engines Are Gaining Momentum

Meanwhile, smaller search engines focused on privacy and environmental impact are gaining traction.

Ecosia, the Berlin-based engine known for using ad revenue to fund tree-planting, saw 4.3 billion total visits during the year—an increase of 17.79% year-over-year. Monthly visits averaged 360.3 million, with 13 million daily visits recorded in March 2025.

“Ecosia’s growth remains steady, with a significant uptick in late 2024 and early 2025,” the report states. Analysts attribute the increase to the platform’s “growing brand presence and environmental mission,” which continues to resonate with eco-conscious users globally. The report also cites Ecosia’s integration of AI tools as contributing to its sustained engagement, calling the engine “a noteworthy alternative in a crowded field.”

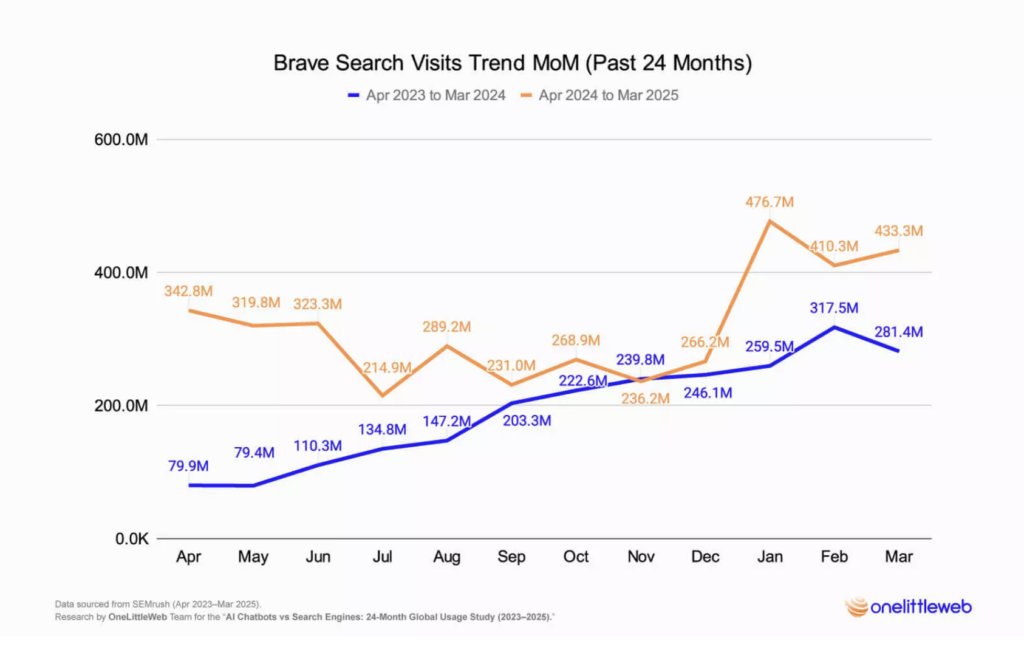

Privacy-focused Brave Search emerged as another breakout player, experiencing a dramatic 64.20% jump in total visits to 3.8 billion, up from 2.3 billion the year before. The platform drew 317.7 million visits per month on average and 14.4 million daily visits in March 2025.

“Brave Search’s impressive growth highlights its emergence as a key player in the search engine market,” the report says. A sharp spike in traffic in January 2025, when monthly visits surged to 476.7 million, was linked to increased awareness and user interest in privacy-driven alternatives. “Its privacy-first model is clearly resonating with users disillusioned by mainstream engines,” the report concludes.

Even AOL, once thought to be on the brink of irrelevance, has shown signs of life. It logged 2.7 billion visits, a 13.07% increase from the previous year. Monthly averages reached 225.2 million, and March 2025 recorded 9.3 million daily visits.

The report frames AOL’s rise as a “steady recovery,” suggesting that while its market share remains modest, the engine is benefiting from nostalgia, renewed content efforts, and steady improvements to its user interface.

As the AI arms race continues among major platforms, the search engine ecosystem is becoming more dynamic, with new players gaining ground by differentiating themselves through environmental values or privacy features.

“While legacy engines struggle with stagnation or decline, smaller players are leveraging clear value propositions to carve out loyal user bases,” the report concludes. “In a post-AI search era, adaptability and trust may matter as much as scale.”